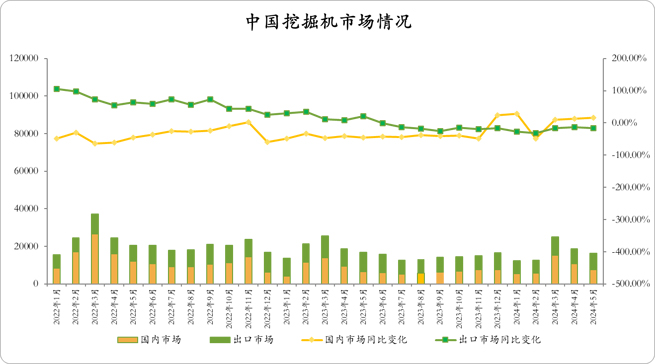

Through grassroots surveys and market research, CME estimates that sales of excavators (including exports) in May 2024 will be around 16,200 units, a year-on-year increase of about 5%, and the market will gradually recover.

By market:

The estimated sales volume in the domestic market is 7,700 units, a year-on-year increase of nearly 19%.

The estimated sales volume in the export market is 8,500 units, a year-on-year decrease of nearly 17%.

According to CME observation data, from January to May 2024, China's overall excavator sales volume decreased by about 9% year-on-year, and the decline continued to narrow. Among them, the domestic market decreased by 0.5% year-on-year, and the export market sales volume decreased by 16% year-on-year.

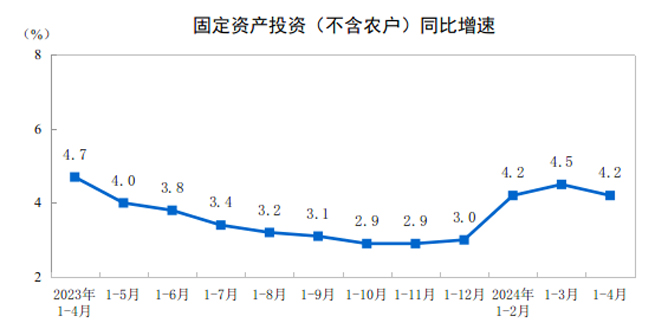

As one of the two major downstream industries of excavator applications, infrastructure investment continues to improve.

From January to April 2024, the national fixed asset investment (excluding farmers) was 143401 billion yuan, a year-on-year increase of 4.2%, and the growth rate was 0.3 percentage points lower than that from January to March. From a month-on-month perspective, fixed asset investment (excluding farmers) in April fell by 0.03%.

In terms of different industries, investment in the primary industry was 263.6 billion yuan, up 1.9% year-on-year; investment in the secondary industry was 476.34 billion yuan, up 13.0%; and investment in the tertiary industry was 931.31 billion yuan, up 0.3%.

In the secondary industry, industrial investment increased by 13.1% year-on-year, of which mining investment increased by 21.3%, manufacturing investment increased by 9.7%, and electricity, heat, gas and water production and supply investment increased by 26.2%.

In the tertiary industry, infrastructure investment (excluding electricity, heat, gas and water production and supply industries) increased by 6.0% year-on-year, among which investment in aviation transportation increased by 24.6%, investment in railway transportation increased by 19.5%, and investment in water conservancy management increased by 16.1%.

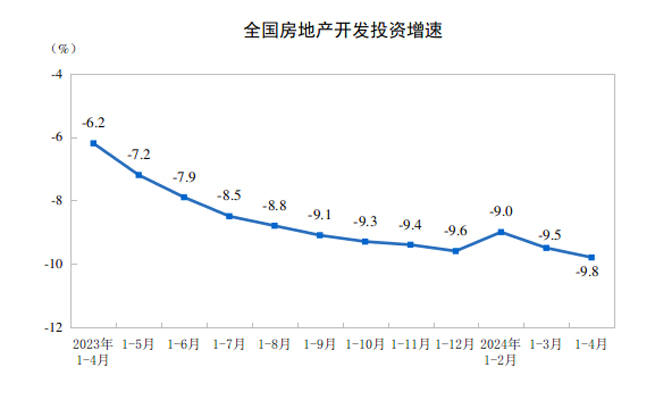

In January-April, the national real estate development investment was 309.28 billion yuan, down 9.8% year-on-year, and the decline was 3 percentage points lower than that in January-March.

From January to April, the housing construction area of real estate development enterprises was 687.544 million square meters, a year-on-year decrease of 10.8%. Among them, the residential construction area was 480.647 million square meters, a decrease of 11.4%. The newly started housing area was 235.10 million square meters, a decrease of 24.6%.

From January to April, the real estate development prosperity index was 92.02.

Real estate consumption demand and confidence are still insufficient, and recovery will take time. Coupled with the decline in land acquisition costs and newly started housing area, the real estate industry is mainly focused on "guaranteeing delivery of buildings" and "destocking", and these two points can be seen in the growth rate of completed area. Although recently, it will take some time for this to be transmitted from the policy side to the sales side. Excavators are mostly used in the early stage of real estate construction, and the newly started housing area and excavator sales are highly consistent, with a significant decline.

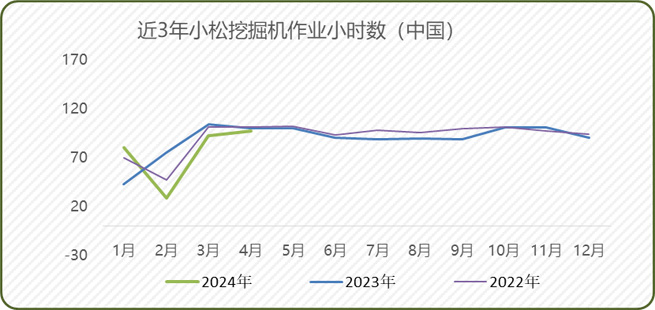

In April 2024, the number of working hours of Komatsu excavators was 97.0 hours, a year-on-year decrease of 3.2%.